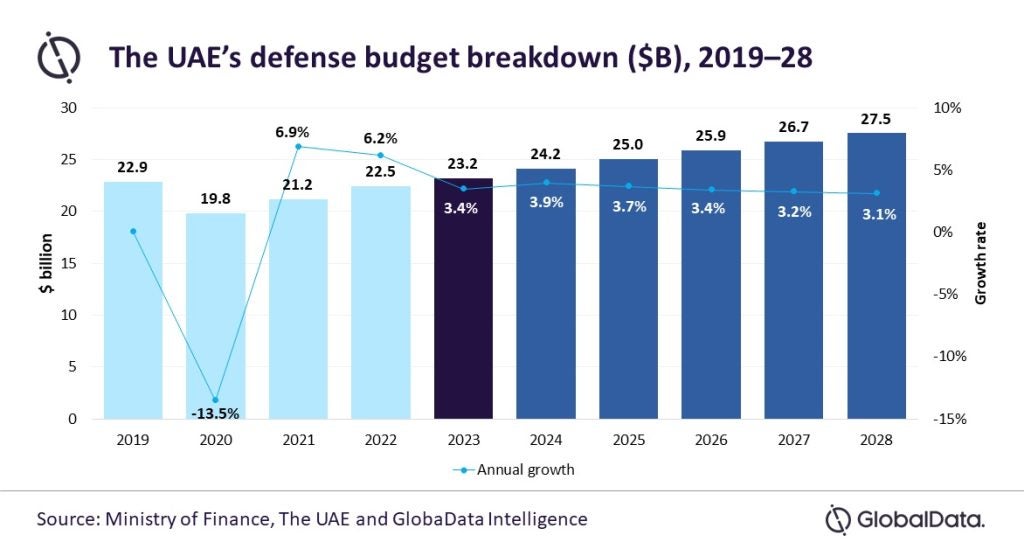

The UAE’s commitment to cumulative defence investment – which will exceed $129bn between 2024-28 according to GlobalData – gives us a taste of the plans ahead for the Gulf country.

As the second largest investor in the defence sector after Saudi Arabia in the Middle East, the UAE plans a two-pronged approach to its defence industry.

The country aims to further deter Iran from taking an aggressive posture in its support of Houthi insurgents in Yemen, and to lessen the domination of US suppliers in the Emirati market.

GlobalData’s latest findings tell us that the UAE’s military expenditure makes it one of the most lucrative defence markets in the Middle Eastern region.

The UAE’s acquisition expenditure, which recorded $4.1bn in 2023, is anticipated to grow at a CAGR of 5.7% to reach $5.1bn in 2028.

This goes toward their goal of modernising their defence capabilities to defend against Iranian and Iranian-backed Houthi offensive operations.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

The Iranian threat

Although the UAE withdrew troops from Yemen in 2019, it still faces danger from Iran and the Houthi insurgents.

These terrorist forces have weakened the authority of the Yemeni government and have created intra-coalition fissures.

The UAE continues have direct control over several non-state armed militia groups with an aggerate strength of as much as 90,000 personnel. They continue to extend indirect support to these groups by providing capacity building, direct training, logistical support, and even regular salaries to groups.

Modernisation is important to sustaining these efforts, and the cumulative investment will go a long way to deter Iranian threats.

The acquisition component of defence expenditure is anticipated to grow at a CAGR of 5.7%, owing to the need to modernise the UAE Defence and Security Forces, with specific emphasis on counter-insurgency measures. The threat of Iran meddling in Middle Eastern affairs will compel the UAE to maintain its robust defence posture, thus ensuring defence spending GlobalData says in their report on The UAE Defence Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape, and Forecast, 2023–28.

Luring foreign industries

Akash Pratim Debbarma, aerospace and defence analyst at GlobalData, comments: “The UAE’s efforts to develop its domestic defence capabilities encourages foreign defence companies to start joint ventures with domestic companies”.

One of the challenges the UAE faces in cultivating a more independent internal defence market is their reliance on US suppliers which command a market share of 64.1%.

Other suppliers willing to enter the Emirati market can expect tough competition from the US-based industries.

One way the UAE plans to lure in foreign supply is by hosting the next biennial defence exhibition IDEX from 20 to 24 February 2023, which will act as a perfect market route for companies to showcase their products.

Debbarma adds: “The deals to jointly develop fifth generation aircraft with Russia’s Rostec and next generation multi-mission cargo aircraft with Korea Aerospace Industries show the UAE’s interest in allowing foreign companies to enter its market.”

The UAE’s military fixed wing market is anticipated to be the most lucrative market of the country. Even though it is in the process of procuring 80 units of Rafale F4 from French Dassault, the country still seeks to procure additional combat aircraft. With the ongoing Russia-Ukraine war, it is unlikely to expect the UAE signing any contract with Russia. However, GlobalData expects the European or Korean companies to take interest in this requirement.