EDGE Group announced that it has purchased a 52% share in the Swiss VTOL systems manufacturer ANAVIA on 6 November 2023.

The European company produces a range of industry-leading unmanned helicopters for various mission profiles such as surveillance and reconnaissance, inspection, and mapping and cargo, which can be adapted to EDGE’s complementary portfolio of air, land, and maritime capabilities.

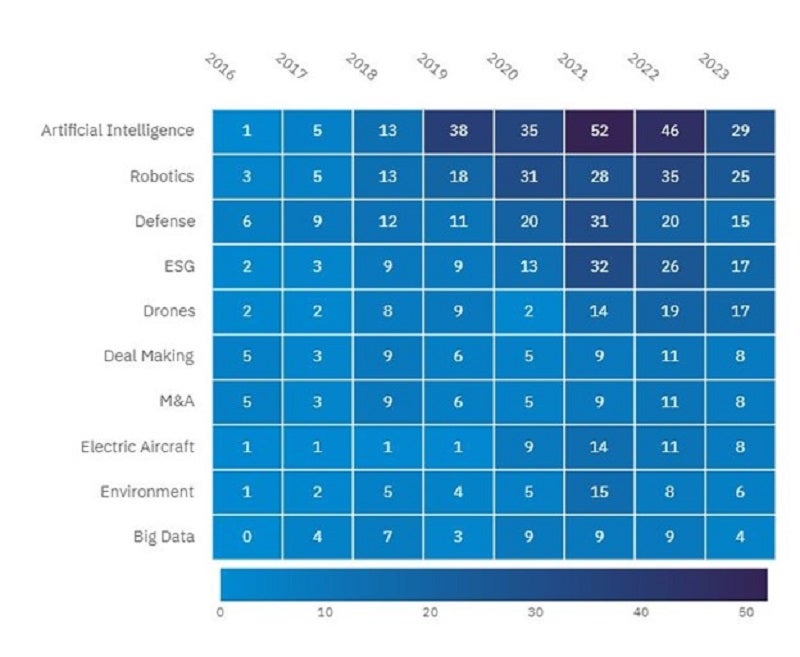

The Group is placing a major focus on the development of autonomous systems, a decision that complements GlobalData’s company filings intelligence. The intelligence consultancy indicates that artificial intelligence (AI) is the leading theme in the defence and aerospace industry with 29 mentions so far this year.

AI is closely followed by robotics (25 mentions) and drones (17), while electric aircraft (8) also makes the top ten themes mentioned in company filings this year.

“The acquisition of a majority share in ANAVIA is an important step in EDGE’s strategy of bolstering its advanced autonomous aerial vehicle capabilities as it rapidly expands its portfolio of multi-domain systems,” Mansour AlMulla, Managing Director & CEO of EDGE Group stated.

ANAVIA employs a highly-skilled team of experts in the autonomous aircraft domain, covering areas such as composite, mechatronics, aircraft maintenance, flight testing and software engineering.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“It will also allow ANAVIA to take advantage of EDGE’s scale and the opportunities this presents for further innovation across relevant areas of the group,” AlMulla added.

EDGE has begun to consolidate industry in South America, particularly in Brazil, where the group has made company share purchases and set-up teaming arrangements with Government institutions. There, the group is embarking on the development and manufacture of next-generation smart weapons.

Increased demand for Unmanned Aerial System (UAS)

The global military UAS market was valued at $7.9bn in 2022 and it will continue to grow at a compound annual growth rate of 4.2% to reach a value of $12bn by 2032, according to GlobalData intelligence.

Modernisation drives initiated by leading countries are replacing enduring fleets, developing domestic UAS platform programmes, and implementing network-centric warfare (NCW) stratagems.

The latter is a factor to watch out for, as defence companies such as the American UAS manufacturer have recently received $2.7bn in a series F funding round to support the research and development of its ongoing AI pilot: ‘Hivemind’.

Hivemind enables teams of intelligent aircraft to operate autonomously in high-threat environments at the edge, without the need for remote operators, command inputs or a global positioning system.

When AlMulla states that the deal will enable EDGE “to complement our existing range of autonomous aerial systems, and [ANAVIA’s] established supply chains, to become a market leader in this field,” the group may be looking to secure a NCW pilot that works alongside other autonomous vehicles in the EGDE Group portfolio.

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors, and indicate where leading companies are focusing their investment, deal-making and R&D efforts.