The Japanese government offered to buy out JSR, a leading semiconductor equipment manufacturer on 26 June.

A government-backed fund – the Japan Investment Corporation (JIC) – announced that it will acquire shares of the company through a tender offer that will commence in December this year.

JIC seeks to purchase 207.7m shares, which will cost approximately Y904bn ($6.3bn).

The government-backed fund explained that “the tender offer is designed to enable JSR to smoothly and rapidly promote its bold, medium-to-long-term strategic investments without being bound by the short-term impact on business performance.”

Semiconductors in defence

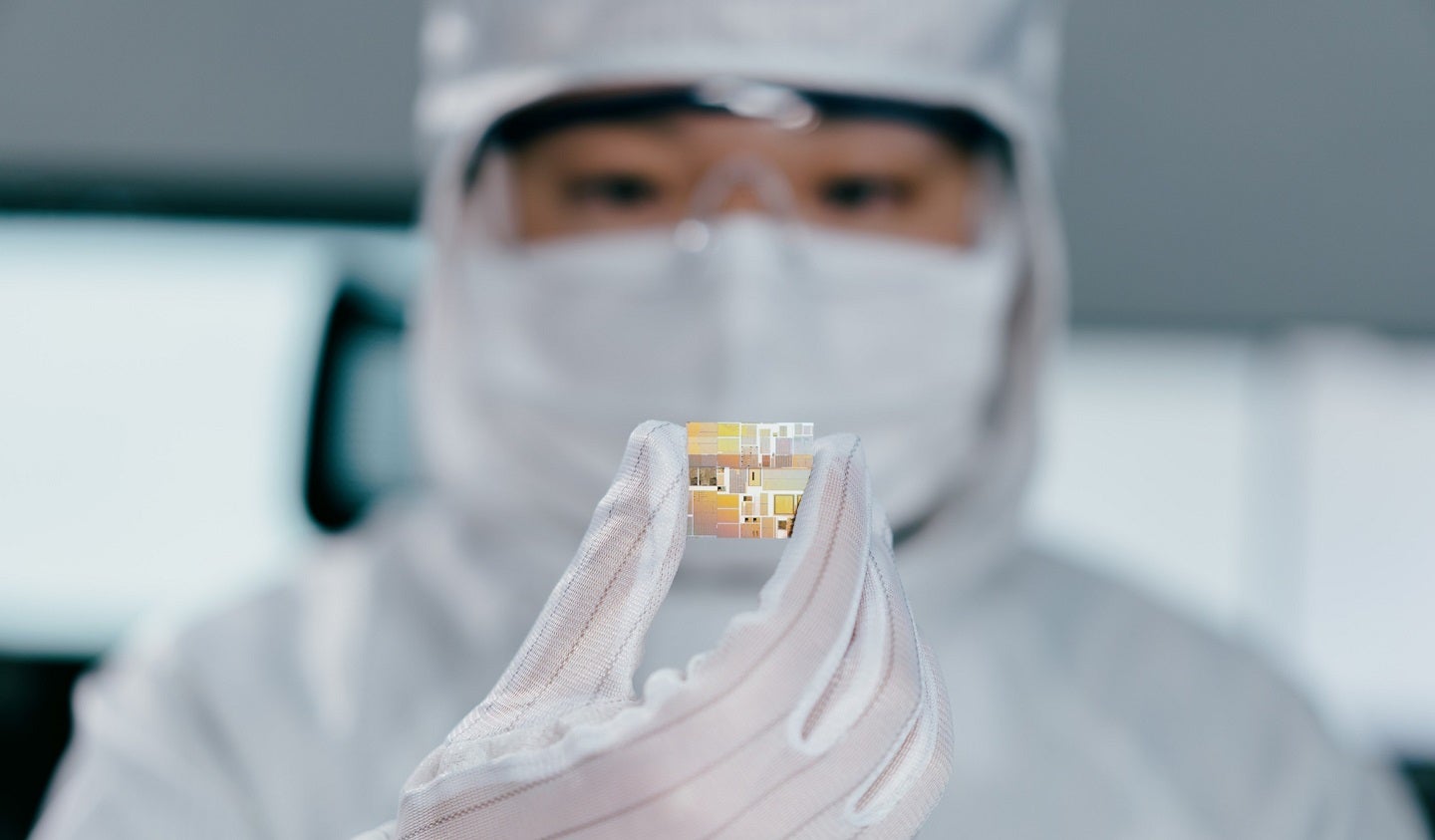

Semiconductors are disruptive in the technology market, especially when it comes to defence technology. They are important components in a wide variety of systems: from missile launchers to communication and navigation systems.

At the centre of the global semiconductor market, the US and China are competing in their so-called ‘chip wars’ in order to gain the advantage in their wider geopolitical and military rivalry. Therefore, securing semiconductor material supply chains has become a military necessity.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobalData defence analyst, Sourabh Banik, gave insight into Japan’s move to strengthen its control over its semiconductor supply chains as the country looks to shore up its defence.

“Just like other industries, semiconductors play a crucial role in aerospace and defence sectors, especially when armed forces worldwide are gradually gearing towards network-centric warfare. Almost all types of modern military platforms, ranging from airborne, land, naval, and space systems, are fitted with components and sub-systems that use semiconductor chips.

“With this deal, Japan’s government will have a hold on a crucial entity within the global semiconductor supply chain amid the growing threat of disruption that may occur due to a potential Chinese invasion of the Taiwanese Islands.”

Just after news of the deal circulated, on 27 June, the Institute for International Strategic Studies (IISS) held a webinar exploring the importance of semiconductor policy collaboration among like-minded countries.

Hosted by IISS representatives – Robert Ward and Togashi Mariko – panelists Meghan Harris, Director of Policy for Worldwide Aerospace and Defense at GlobalFoundries; Dr Chi Ung Song, Senior Research Fellow at the Republic of Korea’s Science and Technology Policy Institute and Ota Yasu, a Tokyo-based columnist and TV commentator for Nikkei with more than 30 years of journalism experience provided insight into the global race for semiconductors.

The experts discussed how collaboration can be achieved between the US, Japan and South Korea – three leading semiconductor producers – as they try to decouple from the dominating influence of China’s supply chains.

Japanese deal marks the “new synapses between government and business”

There is a need for “new synapses between government and business,” Ward indicated.

Harris added government policy should explore “how to provide the most conducive environment in which companies compete and be profitable,” while ensuring “national security interests.”

The deal for JSR secures the country’s supply chains for the critical equipment that goes into semiconductors.

“Although it can be seen by some as government protectionism, it may also be part of a wider initiative by the QUAD members to address the vulnerabilities associated with global supply chains through the Supply Chain Resilience Initiative (SCRI) agreement.

“This trilateral agreement was launched in 2021 between India, Japan, and Australia with the focus of veering away from their reliance on China.

“Furthermore, Japan’s government wants to have a hold on this strategic sector, so that it can safeguard the interests of its domestic giants such as Sony, Panasonic, NEC, Hitachi and others,” Banik added.

JSR explained that the tender offer is designed to enable the company to “smoothly and rapidly promote its bold, medium-to-long-term strategic investments without being bound by the short-term impact on business performance.”

“We have to ally to deter Chinese growth”

While the deal for JSR strengthens Japan’s national interest as a player in the global semiconductor industry and secures its defence technology base, the IISS panel still emphasised the need for government to government collaboration as the threat of Chinese tech looms.

“We have to ally to deter Chinese growth of technology advancement,” Yasu asserted.

The panel agreed that leveraging each partner’s strengths is the best way forward. Whether that be to “supporting Japanese companies investing in Korea”, as Song suggested, or integrating new emerging manufacturing bases in countries like the UK or India.

The UK is “focused on [the] design” of semiconductor equipment, Harris identified, while India is “eager [to develop its growing] manufacturing capability, Song pointed out. This appears to be a potential path to take in order to decouple from countries’ reliance on Chinese material supply.

When asked what role Japan should play in the “Chip 4” alliance – the four largest producers of semiconductors – Yasu suggested that Japan should balance its national interest in the contentious industry with global collaboration when he suggested that the country should take a prominent role within the Asia-Pacific region.

“Japan should not just follow the US, but get together with [South] Korea and Taiwan,” he recommended. “Maybe Japan should co-ordinate the voices of the Asia-Pacific and bring it to Washington.”