According to a recent market research report from GlobalData, “The Global Naval Vessel and Surface Combatants market 2023-2033″ is expected to reach $65.8bnby 2033, with indigenous warship design and construction initiatives driving the market growth.

Emerging militaries such as India, Brazil, Turkey, and Australia are expected to focus on acquiring indigenous warship designs and construction capabilities, further driving market growth. Territorial disputes and the need to exploit offshore resources have also contributed to strengthening naval capabilities globally.

In 2022, the Indian Navy commissioned its first indigenous aircraft carrier, the INS Vikrant. The vessel was commissioned to provide enhanced maritime security in the Indian Ocean region.

India has invested in R&D defence spending in the naval industry after witnessing constant maritime expansionism from China in the Indian Ocean, with China developing ports or naval bases in Pakistan, Sri Lanka, Bangladesh, Myanmar, and recently, Cambodia, where it has conducted military exercises.

Vinayak R Kamath, aerospace and defence associate analyst at GlobalData, comments: “The indigenous shipbuilding initiatives facilitate the advent of a strong industrial ecosystem and reduce the dependence on imports.

“This also enables the local enterprises to integrate new functionality and weapons systems throughout the entire lifespan of the vessel.

“For instance, Turkey is building a whole range of vessels under its national warship procurement program (MILGEM). Other countries such as India, China, and Australia have undertaken multiple indigenous shipbuilding projects in recent years.”

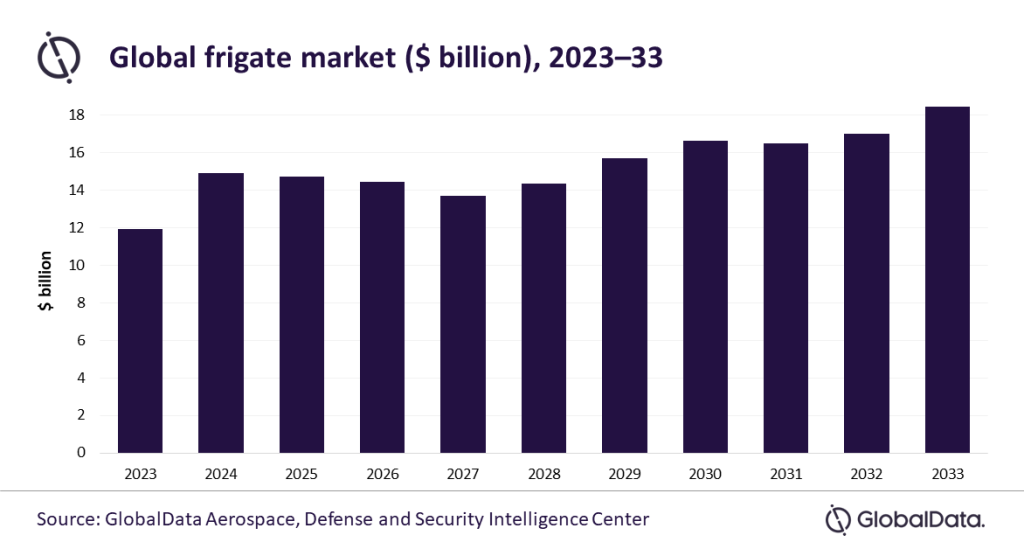

The frigate segment is anticipated to be the largest in the naval vessels and surface combatants market over the forecast period. Increasing demand for frigates with multispectral capabilities, including advanced air defence and anti-submarine warfare, is expected to drive the segment’s growth globally.

Over the next ten years, countries will spend $168.2bnto procure frigates cumulatively. Major programs aiding in the growth of this sector include the US acquisition of a Constellation-class frigate, the Australian acquisition of Hunter-class (SEA 5000) frigates, and Canada’s plans to acquire Canadian Surface Combatants (Type 26 Frigates).

With the growing focus on indigenous warship design and construction capabilities, emerging maritime threats and fleet modernisation initiatives, the global naval vessel and surface combatants market are expected to grow significantly in the coming years.

Kamath concludes: “Geopolitical tensions, supply chain disruptions and potential delays in delivery, and access to new technologies that cater to local requirements or to easily retrofit onto in-service vessels have reinforced countries to pursue their own indigenous programmes.

“Moving forward, GlobalData expects such programmes or those where indigenous development playing a major role in more markets.”