While Goldman Sachs and Houlihan Lokey continue to reign in the M&A financial advising realm, GlobalData’s report sheds light on the nuanced dynamics shaping the market landscape, revealing insights beyond the mere numbers.

GlobalData’s Deals Database and recent analysis of the mergers and acquisitions (M&A) financial advising landscape in North America for 2023 shows the undeniable dominance of industry players Goldman Sachs and Houlihan Lokey. However, beyond the figures that cement their positions at the top lies a narrative of resilience and evolving market dynamics.

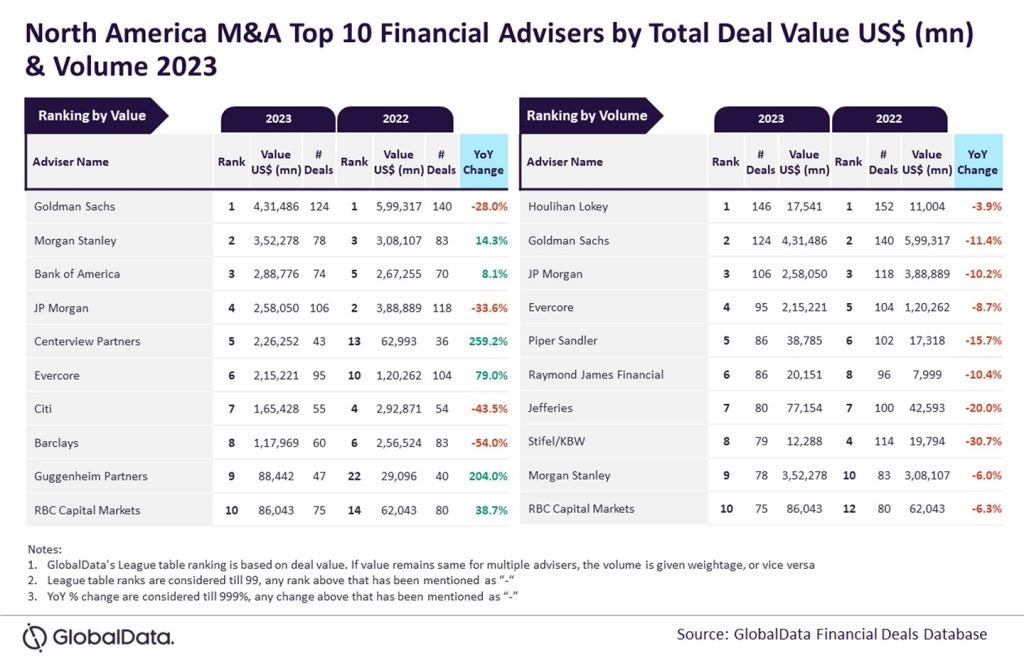

While Goldman Sachs clinched the top spot in deal value, advising on $431.5bn worth of deals, Houlihan Lokey secured its leadership position in deal volume, steering 146 transactions throughout the year. Yet, the story extends far beyond the numerical achievements, delving into the strategic manoeuvres and industry trends that propelled these firms to the forefront.

Aurojyoti Bose, Lead Analyst at GlobalData, offers a nuanced perspective, noting that despite a dip in total deal value for Goldman Sachs compared to the previous year, the firm showcased resilience, mainly through its involvement in high-value transactions. “Despite experiencing a decline in the total value of deals advised by it in 2023 compared to 2022, it was the only adviser to surpass $400bn in total deal value.”

Goldman Sachs’ advisory role in 59 billion-dollar deals, including 11 mega deals exceeding $10bn, showed its acumen and ability to navigate complex transactions.

In 2023, Goldman Sachs’s wealth and asset management division saw a notable increase in net revenues, reaching $13.88bn, a 4% rise from the previous year. The private banking and lending sector saw a particular uptick, with net revenues climbing from $2.458bn in 2022 to $2.576bn in 2023, driven by higher deposit spreads and balances.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSimilarly, Houlihan Lokey’s consistent performance in deal volume reflects its deep-rooted client trust in navigating myriad transactions. Falling just shy of the 150-deal mark, the firm demonstrated consistency in a landscape fraught with uncertainties and evolving market dynamics.

However, an analysis of GlobalData’s Deals Database goes beyond spotlighting the frontrunners, offering an overview of the competitive landscape. While Goldman Sachs and Houlihan Lokey led the pack, other industry stalwarts such as Morgan Stanley, JP Morgan, and Bank of America carved out roles, each leveraging unique strengths and strategies to capture market share.

Morgan Stanley’s second-place position in deal value, amassing $352.3bn worth of transactions, shows the competition within the industry, with each firm vying for an advantage and market dominance.

As the M&A landscape evolves, characterised by shifting market trends and geopolitical uncertainties, the significance of financial advising services provided by firms like Goldman Sachs and Houlihan Lokey becomes increasingly pronounced. Beyond the numbers, their success reflects a vision, resilience, and adaptability, shaping the trajectory of M&A activities in North America and beyond.