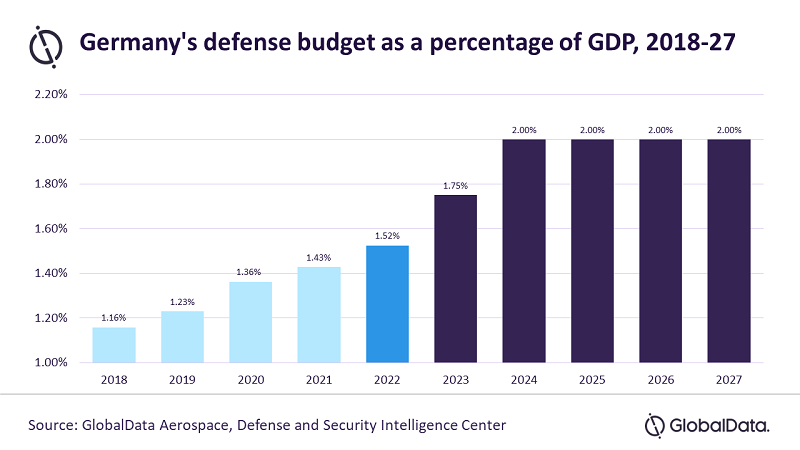

Germany’s promise to increase its defence budget to 2% of its gross domestic product (GDP) by 2024, with this figure then being sustained as an average across a rolling five-year period, will equate to a defence budget of $82.0bn in 2024, rising to $85.7bn in 2027, according to GlobalData.

This will result in a positive compound annual growth rate (CAGR) of 5.0% between 2023 and 2027, which is a slower rate of growth compared to the 2018-22 period, which saw a positive CAGR of 7.3%. GlobalData’s latest report, ‘Germany Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-2027’, notes that Germany may struggle to spend the planned budget increases unless a reformed approach to the defence industry is implemented.

Madeline Wild, associate defence analyst at GlobalData, commented: “In order to utilise the growth in its defence budget, Germany must review its approach to the defence industry. Currently, there is a lack of a strong defence industrial strategy meaning that the country is not unlocking the full potential of its relationship with the industry.”

Germany releases a short policy document every few years outlining its plan to strengthen the industry. What is lacking, however, is the utilisation of the defence industry as a strategic tool: by encouraging investment and funnelling spending into certain areas to promote job growth and economic stimulation. Creating a strong policy would help Germany to spend its new funds effectively, efficiently and have maximum impact on both the capabilities of its military and feeding back into the domestic economy.

Wild added: “One problem that Germany faces in this realm is public acceptance. In comparison, the UK released its Defence and Security Industrial Strategy paper last year, which highlighted across hundreds of pages (compared to Germany’s ten) how the Ministry of Defence would use and develop the industry in the hopes that the impact would be felt beyond the defence sector.

“However, the UK public is, on the whole, far more accepting of government support of the defence industry. The German public is relatively more cautious, with a greater focus on arms control.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIndustrial policy review is not the only barrier to spending the new defense funds effectively. Ongoing issues with the procurement department (BAAINBw) have already caused up to 10% of the acquisition budget to go unspent in some years, despite efforts to reform the department.

Wild continued: “Problems within BAAINBw are well publicised, with low staff numbers and overly bureaucratic procedures preventing the effective spending of the defense budget. Successive defence ministers in Germany have tried to address these problems and overhaul the department. Until this is achieved, BAAINBw will continue to act as a significant hurdle for the Bundeswehr.”

Meanwhile, neighbouring Switzerland could prove to be a profitable market over the next decade for foreign defence companies such as Lockheed Martin, Saab and Elbit Systems, as the country’s steadily growing defence budget allocates more funds to acquire defense capability on the international market.

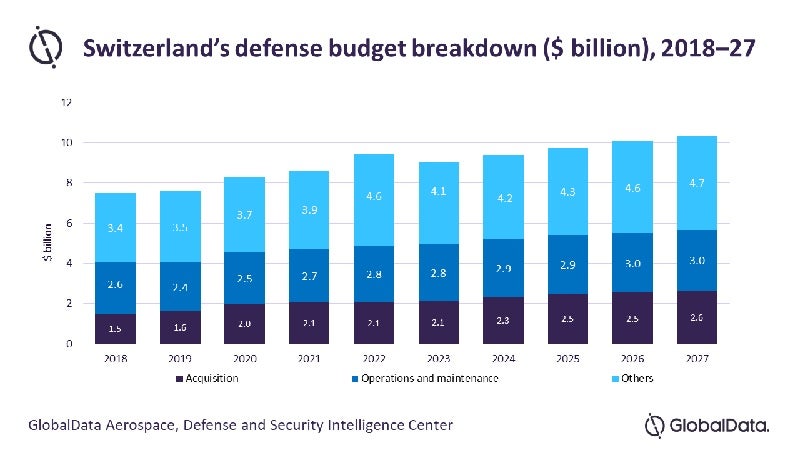

According to the GlobalData’s report, ‘Switzerland Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-2027’, reveals that Switzerland’s defence budget is forecast to grow from $9.44bn in 2022 to $10.35bn in 2027, with funding split between acquisitions, operations and other ancillary costs including training, pensions, intelligence activities and miscellaneous services.

The budget allocation for acquisitions has continued to grow, rising from $1.5bn in 2018 to reach $2.2bn in 2022 and GlobalData forecasts that it will reach $2.6bn by 2027.

Tristan Sauer, land domain analyst at GlobalData, commented: “While this increase is primarily due to the Air2030 programme, other acquisitions such as the purchase of six Hermes 900 Medium Altitude Long Endurance (MALE) unmanned aerial systems from Israeli firm Elbit Systems under the ADS 15 programme illustrate the diversification of the Swiss military’s modernisation initiatives.”

Over the forecast period, the main drivers of Swiss defence expenditure will be the need to modernise its air defence forces in order to ensure the continued defence of its territory from external threats. The Air2030 programme will provide Switzerland with 5th generation F-35 fighter jets capable of responding to advanced threats in Swiss airspace.