The aerospace and defence industry continues to be a hotbed of innovation, with activity driven by the uptake of advanced technology, and growing importance of technologies such as hypersonics and advanced materials. In the last three years alone, there have been over 174,000 patents filed and granted in the aerospace and defence industry, according to GlobalData’s report on Innovation in Aerospace, Defence & Security: Gas Turbine Engine Testing. Buy the report here.

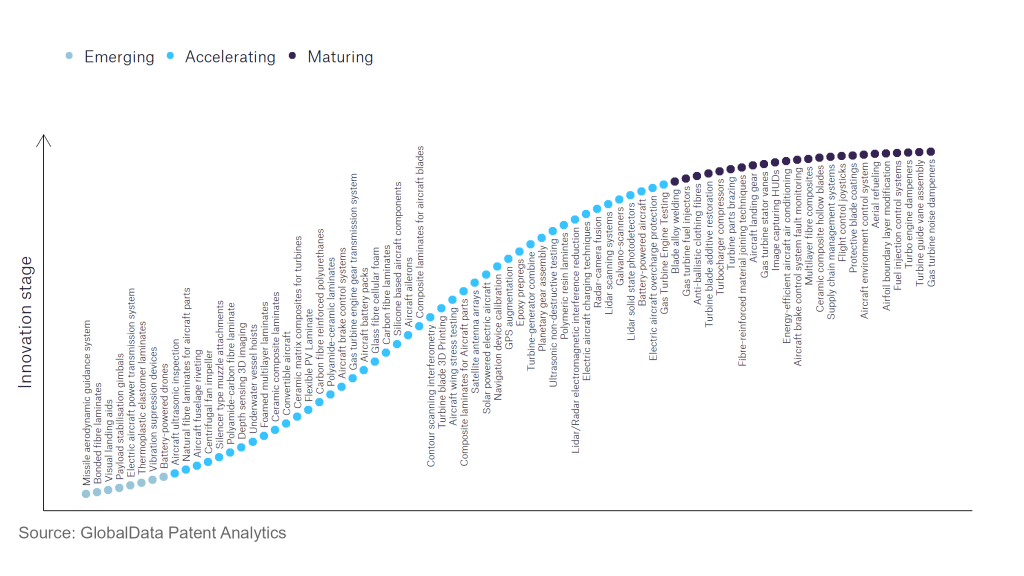

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

180+ innovations will shape the aerospace and defence industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defence industry using innovation intensity models built on over 262,000 patents, there are 180+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, bonded fibre laminates, thermoplastic elastomer laminates, and vibration supression devices are disruptive technologies that are in the early stages of application and should be tracked closely. Centrifugal fan impellers, ceramic composite laminates, and gas turbine engine testing are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are protective blade coatings and blade alloy welding, which are now well established in the industry.

Innovation S-curve for the aerospace and defence industry

Gas turbine engine testing is a key innovation area in aerospace and defence

A gas turbine engine utilises a rotating gas compressor, a combustor and a compressor driving turbine to operate. Testing facilities can increase innovation potential and provide companies with the necessary resources to develop new technology as long as they can provide accurate results.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established aerospace and defence companies, and up-and-coming start-ups engaged in the development and application of gas turbine engine testing.

Key players in gas turbine engine testing – a disruptive innovation in the aerospace and defence industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to gas turbine engine testing

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Safran | 99 | Unlock Company Profile |

| General Electric | 53 | Unlock Company Profile |

| Rolls-Royce Holdings | 30 | Unlock Company Profile |

| Raytheon Technologies | 14 | Unlock Company Profile |

| Siemens | 14 | Unlock Company Profile |

| Beijing Aerospace Sanfa High-Tech | 11 | Unlock Company Profile |

| Durr | 11 | Unlock Company Profile |

| BorgWarner | 8 | Unlock Company Profile |

| MDS Aero Support - Management Team | 7 | Unlock Company Profile |

| Aecc South Industry | 6 | Unlock Company Profile |

| Boeing | 6 | Unlock Company Profile |

| IHI | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Safran is the leading patent filer in this sector. It is a major aerospace and defence company which conducts extensive ground testing of engines before they undergo flight tests. Testing systems utilised by Safran examine flight safety, performance and efficiency, and filings for advanced testing facilities can provide greater accuracy for these metrics. The second leading patent filer in this sector is General Electric, which runs a leading gas turbine testing facility. The company’s patents seek to advance the capabilities of this facility. Other key companies include Rolls-Royce and Raytheon.

By terms of application diversity, Boeing is top, followed by Rolls-Royce and MDS Aero. By geographic reach, Durr is top, followed by Safran.

Innovations in this sector can provide more effective and detailed testing which can significantly benefit the aerospace and defence industry.

To further understand the key themes and technologies disrupting the aerospace and defence industry, access GlobalData’s latest thematic research report on Defence.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.