The organisers of DSEI 2025 trumpeted their extra hall space at the ExCel in London which, they said, encompassed more than 20% extra space than the previous year to situate more than a hundred additional companies.

But this region of the convention centre, located apart from the main pavilions, on the east wing, reflected a unique melting pot of companies which accurately represents the defence industry right now.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

It is a space that held Anduril, a frontrunner in the global defence industry, but also the likes of Amazon Web Services, a supplier of satellite and cloud services in the civilian sector.

During the event, DSEI spokesperson Neil Sexton told Army Technology that the Tech Zone represents a change in the way that the show has developed since the last exhibition in 2023.

“It’s a space that we’ve not had previously,” he said, which ten years ago exclusively contained conventional, heavy metal hardware, but now a lot of the companies are “developing artificial intelligence and roles for that inside defence equipment,” Sexton maintained.

A lot of this is coming from the civil sector as much, if not more, than the military sphere.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“We’ve always seen in defence that historically capabilities developed by militaries have then been picked up in the civil sector and expanded into other uses. That’s much more of a two-way street these days.”

Echodyne

One company situated in the Tech Zone was Echodyne, a US-based radar technology supplier, whose co-founder and chief technology officer, Tom Driscoll, discussed the company’s principal concerns in the defence and security markets.

Echodyne conceived of a new, low-cost radar architecture that reduced the size, weight and power while maintaining a phased-array beam.

Its key offerings are twofold: software-defined radars, systems that can be updated with new capabilities and improvements, and its new Rapid Deployment Kit (RPK), a system unveiled at DSEI for the first time, consisting of four radars for quick field use and designed for users with sophisticated integrators.

The proliferation of drones, not just in defence but in the civilian sector, such as critical national infrastructure, has prompted Echodyne to contribute to counter-uncrewed aerial system (C-UAS) capabilities.

“Radar is a core… sensor for counter drone and airspace in general,” Driscoll emphasised.

During DSEI, the radar provider signed a memorandum of understanding with ST Engineering, an engineering specialist, to collaborate on C-UAS technologies with an initial focus in Singapore. It is worth noting Echodyne already supplies to the “majority of European countries,” Driscoll said.

“If you’ve got a radar that has breakthrough cost performance… that has really resonated in this problem,” Driscoll observed. “The drone problem, fundamentally, is about a cost asymmetry. We’ve now got $100 drones that can threaten $10m assets.”

When asked about Echodyne’s placement in the thick of the Tech Zone, Driscoll noted that the pickings are slim:

“If you have a certain size booth, you take the spots you can get. I don’t think that this is a bad area, but it’s… not a strategic [location].

“We didn’t say we’re going to be in the Tech Zone because we’re dual-use. I wouldn’t mind being up there next to the beautiful integrations that Rheinmetall has done with our radars, and Kongsberg, and Moog, and MSI. I’ll take a 200 by a 200 booth up there.”

MARSS

Another Tech Zone neighbour is the defence network supplier, MARSS, which offers its flagship NiDAR command and control (C2) system to detect, classify, and respond to multi-domain asymmetric threats.

NiDAR is used to protect static, often military, sites. Currently, several unnamed countries based in the Middle East use the platform. However, at DSEI, the company introduced its latest NiDAR appendage, the Autonomous Mission Management (AMM) system.

The AMM system will act as a ‘middleware’ between autonomous vehicles and the C2 network. Uncrewed systems can be deployed to add another, mobile layer of protection to a fixed military installation. MARSS is already forming partnerships with uncrewed systems makers, most notably Milrem Robotics, integrating its THeMIS uncrewed ground vehicle (UGV).

Within the next 18-24 months, MARSS’ chief executive, Johannes Pinl, predicted that transition to a fully autonomous battlespace, where warfare will essentially come down to “machine vs. machine” engagements across land, sea, and air.

To this end, MARSS’ AMM is positioning for this transition in which Pinl suggested that a range of different kinds f drones will work in unison to create a holistic picture for C2. Pinl alluded to the use of tracked UGVs like THeMIS, which offer mobility, sensors, and firepower while accompanied in the air by more evasive uncrewed aerial systems (UAS) as scouts, looking ahead to idenitfy obstacles and threats to the UGVs.

Evolve Dynamics

Meanwhile, a UK-based UAS builder, Evolve Dynamics, showcased designs born out of the border patrol and civil security sector.

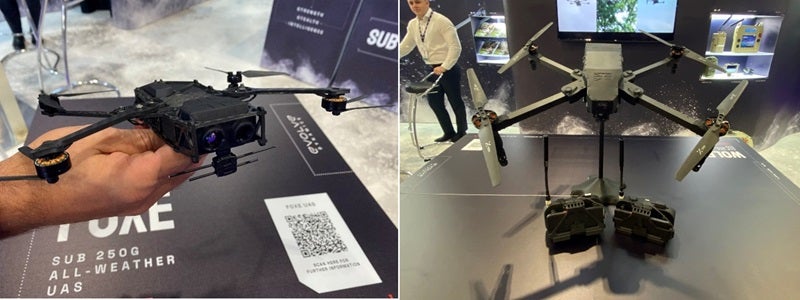

While based in Surrey, around 25% of the company – 50 people – are based in Ukraine where two of its key UAS designs – the medium-sized Wolfe and the nano drone Foxe – which the company unveiled at DSEI 2025, are built off the back of the innovation in the war torn country.

Foxe, meanwhile, is currently conducting trials with the British Army with further “projects ongoing” with Dstl, according to a company representative.

Meanwhile Evolve’s Skymantis 2 UAS system is its larger, and older version, which has already been deployed by the UK Border Force. Skymantis 2 conducts intelligence, surveillance, and reconnaissance missions with a one-hour flight time and optional capacity for a tethered payload which can be drpped mid-flight.

Motorola Technologies

The DSEI Tech Zone also says ‘hello moto’ to Motorola, a telecommunications company. The American company, which prizes dispersed communications and data, showcased its wares to defence users.

Particularly, business representatives noted its latest containerised solution, many of which are designed to offer the end user with multiple layers of communications in disaggreagted and private LT bubbles that can be deployed across a 100 kilometre space.

Motorola’s recently acquired business, Silvus, enahnces the concept by connecting these communications units with the mobile ad hoc networks (MAhN).

One representative confirmed that this disaggregated tactical communications solution – also known as HABLAR, or ‘to speak’ in Spanish – is currently deployed by the German Bundeswehr in a phased approach. The contract was first signed back in 2021.

Now, though, Motorola Technologies is working to bring the concept to the UK Armed Forces with an exercise scheduled for later this year.

Maxar

The Tech Zone also covers the space domain, in which Maxar Technologies dominate satellite imagery, which is utilised for coveted military intelligence.

At DSEI, the US-based company revealed that its has extended its offerings with a new software platform known as ‘Raptor’. Ultimately, the suite enables autonomous drones to navigate and extract accurate ground coordinates in the absence of GPS.

Designed for lightweight integration with any autonomous platform, Raptor products use only a drone’s native camera and Maxar’s 90 million-plus square kilometres of global 3D terrain data to help the platform navigate with extreme precision and extract accurate ground coordinates in real-time in a GNSS-denied environment.

The company also introduced attendees to its new Sentry persistent monitoring suite. Sentry integrates automated multi-constellation tasking orchestration, real-time data fusion and artificial intelligence-driven analytics.

Maxar designed the capability to monitor hundreds of areas around the world to solve complex problems such as anticipating adversarial threats or protecting industrial infrastructure.

Sentry products draw on Maxar’s 250+ petabyte archive of high-resolution satellite imagery collected over more than two decades. These capabilities enabled rapid identification of aircraft, ships, vehicles and railcars, object counts and classification – laying the groundwork for identifying trends and anomalies.